Congratulations! Your child completed college, scored their first job, and is hopefully on the path to financial independence!

Your child’s first job – and first paycheck – after college should be the first time he or she is thinking about the long-term, and the role this moment may play in their financial journey. These important “firsts” not only come with tremendous responsibility, but also present an opportunity to improve their chances at financial success. ![]() With a whole future ahead, where to start?

With a whole future ahead, where to start?

A good plan starts with education and removing potential roadblocks to success.

Educate your child about debt and credit – and that not all debt is equal. Establish a plan to reduce or eliminate high-interest and student loan debt and communicate the value of having (and maintaining) a good credit score.

Next, encourage your child to live beneath their means and establish a protective mindset. This will help them establish sound habits today that will benefit their future and position them to avoid the common pitfall of lifestyle “creep” later on.

![]() Budgeting is the cornerstone of financial literacy

Budgeting is the cornerstone of financial literacy

Budgeting is a foundational step to help your child understand their post-grad means and how a protective mindset can be implemented.

Budgeting should build early awareness about spending decisions and instill habits that promote financial stability over time (for example, cooking at home rather than ordering take-out).

To start, your child should understand their income, differentiate between fixed and optional expenses, and ensure core needs are covered. There will be expenses, such as healthcare premiums, that your child may not have previously considered.

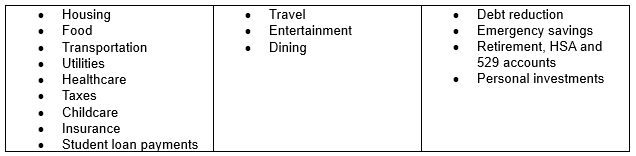

A comprehensive budget should be future oriented, and consider:

For many, especially those starting out, needs can be all-consuming, making it challenging to allocate money to lifestyle wants and goals or saving.

Parental Tip: If you want to support your child during low-income years, consider contributing to their wants or goals. This allows your child to remain accountable for their core needs and establish independence while still benefiting from your support.

![]() Let’s Save – Where to start?

Let’s Save – Where to start?

Once essential needs have been addressed, navigating the balance between enjoying life today and building wealth for the future is crucial.

We recommend breaking down savings goals into buckets:

For spend and save decisions at any amount, remind your child to “pay themselves first” to solidify a robust financial foundation.

![]() Being Prepared: Priceless

Being Prepared: Priceless

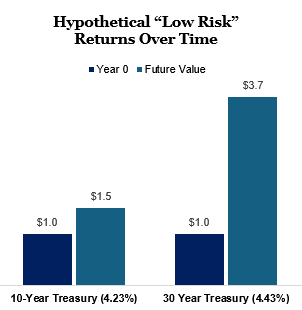

First, establish an emergency fund. A good target is to eventually have 3-6 months of living needs held in low-risk and liquid interest-earning assets such as treasuries or a high-yield savings account. Having this financial safety net should provide peace of mind when navigating unexpected situations like medical bills or job loss.

Tip: An overfunded emergency fund can provide the financial agility needed for timely opportunities such as relocation, a career pivot, or even a strategic investment.

![]() Forward Thinking

Forward Thinking

Teach your child that time is perhaps their most powerful financial asset. Saving early allows compound interest to propel savings growth forward, which can influence the options available to your child later. Long-term saving benefits the most from time and compounding growth (see chart).

Let’s assume your 21-year-old invests $1,000 at a 4% annual return. At 40, they will have $2,107, more than double their money, and at retirement (70) they will have $6,833, almost a 600% return. If that same person waited until 40 to invest the same $1,000, they would have $3,243, or less than half at retirement.

Tip: The opposite is also true! Interest payments on accumulated debt can erode wealth. Pay down high-interest-bearing debt such as student loans and credit card balances as efficiently as possible.

![]() Be Intentional

Be Intentional

Encourage your child to contribute to suitable tax-advantaged plans (i.e., 401(k)s, IRAs, HSAs etc…) as soon as they are eligible. Generally, these accounts can be either:

Roth plans offer greater flexibility, especially with regards to estate planning, but come with income limits and participation restrictions. Therefore, early participation in these plans is advised when possible.

Tip: Many employers offer a 401(k) match – essentially free money – which also compounds with time. Not participating is like leaving part of your paycheck on the table.

![]() Your child’s future self says “thank you”

Your child’s future self says “thank you”

One easy way to build savings is to automate it. Encourage your child to set up an automatic payroll deduction directly into their savings accounts. When possible, we recommend maximizing government benefits. However, allocating even a small percentage of income (10% if possible) to these accounts can have a meaningful long-term impact.

Helpful facts: For those under 50, The 2025 income contribution limits for 401(k) and similar plans is $23,500 and IRA limits are $7,000. Single individuals may contribute to a Roth IRA if income is $146,000 or less. Health Savings Accounts (HSAs) offer similar benefits for health-related expenses.

![]() Proactive financial savings today enables milestones later

Proactive financial savings today enables milestones later

With a secure financial foundation in place, your child can confidently allocate funds toward personal lifestyle goals and wants.

Remind your child that this process is ultimately an investment in their future and a way to open doors to attain important goals. These goals are endless, and may include owning a car, saving for a first home, planning a wedding, taking a big trip, or seeking higher education. With diligence and focus, this “goals” bucket can grow to service exciting opportunities well into adulthood.

Tip: Surplus funds in this bucket can transition into a personal investment account, compliment retirement savings, and expand wealth generation opportunities.

![]() How Accounts Should Actually be Invested

How Accounts Should Actually be Invested

As your child fully embraces adulthood, they havethe advantage of a long-time horizon and minimal near-term financial obligations. This positions them well to pursue growth-oriented equity investments. A well-diversified equity portfolio, which can also include low-cost index funds or ETFs, can provide attractive return potential over time. However, any funds earmarked for near-term needs should remain in low-risk, liquid assets, such as treasuries.

The earlier your child starts saving, the more dry powder they can access for bigger “wants” down the road.

Once your child has established a decent nest-egg, they can engage a Registered Investment Advisor to manage their funds and advise on future financial decisions.

Other things for your child to consider:

Next Steps:

Reach out! Your family is part of our family.

Not an existing client? We would still love to discuss a smart plan with you and your child.

Together, we can craft early-stage wealth-building and cash flow awareness strategies, aid the allocation of retirement assets, and more.

Disclosure: All opinions expressed in this article are for informational and educational purposes and constitute the judgment of the author(s) as of the date hereof. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual. The material has been gathered from sources believed to be reliable, however PSG cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Some examples are hypothetical in nature and provided for illustrative purposes only; they are not intended to represent the result of any PSG client or predict actual results. PSG does not provide tax, legal or accounting advice, and nothing contained in these materials should be taken as such. This is not the performance of any PSG client portfolio. Investors cannot invest directly in indices.

Click here to download a PDF version.